AI AGENTS: A REGIONAL OPPORTUNITY WITH GLOBAL POTENTIAL

INTRODUCTION

Gen AI has the potential to reshape the entire service industry, with value creation opportunities estimated in the trillions. Just as the SaaS revolution gave rise to numerous billion-dollar companies, the Gen AI revolution could achieve similar, if not greater, outcomes.

The GCC has both the right to play and the right to win. Now is the time for swift action, taking bold, effective steps to seed local players that can become tomorrow's global champions and multi-billion-dollar success stories.

Every ambitious journey starts with a pragmatic approach. This report focuses on Gen AI (not broader AI), and the immediate and low-hanging fruit opportunities for Saudi Arabia and the GCC. We foresee the potential for around ten GCC-based Gen AI companies worth $1-3 billion each within the next five years. These estimates consider Gen AI applications to deliver at least $23b of cost efficiencies within the GCC while excluding the greater upside from revenue enhancement solutions and geographical expansion.

1. AI Agents: a booming global opportunity

This time it’s different

When assessing AI's potential today, we should not rely too heavily on historical trends and past impacts in the fields. Historically, AI capabilities were restricted to forecasting and classification. With Generative AI, machines are now capable of content generation and reasoning, which unlocks new opportunities that were previously out of reach.

Content generation involves an AI model autonomously creating new material (e.g., text, images, and audio) based on its training data, producing unique content similar to human work.

Generative AI basic reasoning works by recognizing patterns in data and using them to make decisions, rather than relying on strict logical rules like conventional AI systems. This allows it to learn from unstructured data and handle uncertainty. These abilities open up a wide range of new possibilities for AI applications.

As investors, we believe the majority of value to be captured in the Generative AI value chain lies in the application layer; i.e. those who are consuming the models to solve specific business use cases. We prefer the application layer over the model layer because: i) it requires a lower capital investment, ii) it involves less regulatory and copyright risk, and iii) there are no significant training costs. For example, a recent Stanford study reported that training OpenAI’s GPT-4 cost $78 million, while Google Gemini’s training cost $191 million. On the other hand, a prototype for a generative AI application can be developed with a few thousands of dollars.

The best way to understand the “Application Layer” opportunity is to compare it to the SaaS boom. The visual below presents a simplified view of the SaaS value chain (left) alongside the Gen AI value chain (right). On the SaaS side, while "Infrastructure" and "Platform" players capture great value, they require significant capital to gain market share and have been mainly commoditized. Similarly, on the Gen AI side, we believe that the "Infrastructure" and "Platform" layers offer less attractive risk-reward returns. Instead, the application layer, particularly AI Agents, will benefit most from the groundwork laid by infrastructure and platform providers.

Application-layer Gen AI is exciting as it gives birth to a new paradigm of human-computer interaction: AI Agents. We believe the base case for AI Agents is to have a role in most industries and to augment (and, in rare cases, replace) many job functions. This change will be rolled out and normalized steadily in the coming years.

Sites, Apps, Agents

The web gave us Sites, smartphones gave us Apps, and Gen AI will provide us with Agents.

As a new paradigm, a vast ecosystem is being built around the development, monitoring, security, and scaling of AI Agents.

What is an AI Agent? It is intelligent software that understands and interprets natural language, reasons and makes decisions based on input, interacts with users in a human-like manner, and takes autonomous actions (including using multiple apps like a human would) to accomplish a task.

Classical AI attempted to mimic agent-like systems using chatbots and if-then rules. The limits of these approaches were easy to discover. On the other hand, LLM-based agents are perceived and behave in manners that resemble humans.

VC Focus and Emerging Use Cases

Historically, investing in "AI Agents" was not a prominent theme for VC funding. However, as the opportunity in the application layer of AI has become more evident, VCs have started to gravitate towards the investment theme of "agentic startups," those developing AI Agents or creating tools and components to build, monitor, secure, enhance, or scale AI Agents.

The US has seen a significant influx of fresh capital into AI agent startups. Excluding OpenAI, over $1 billion has been invested in solutions built on existing foundational models, with a 64% CAGR over the last two years, which is remarkable considering that overall VC investment dropped by 47% during the same period.

VC Deployment in GenAI

A similar trend is evident in emerging markets like India, where total VC funding declined by 75%, yet AI investment surged with an 87% CAGR over the same timeframe.

This trend is also observed in accelerators. Y Combinator’s latest cohort (Summer 2024), Silicon Valley’s most sought-after accelerator, saw 255 accepted applications. Out of those, 76% were directly or indirectly AI Agent startups. For comparison, Summer 2021 had 18% that were directly or indirectly AI Agent startups.

YC batches breakdown by cohort, (S: summer, W: winter)

Theoretically, AI Agents could augment or replace the entire service industry, a $16 trillion global market. Today, however, there are a few functions that represent low-hanging fruit for current technology to tackle:

The four categories above are undoubtedly incomplete. For example, one of the most exciting use cases for AI Agents has been Software Engineering augmentation and automated code generation (e.g., Cursor, an AI-enabled code editor raised $60mn in 2024). Other categories include a plethora of developer-facing tools and platforms to enable the orchestration and scaling of AI Agents.

How does this impact the bottom line? Each of those companies have a long list of case studies on how they helped their clients by reducing costs or increasing revenue. A recent example of employing generative AI in the workforce is Klarna, the FinTech giant of Europe. Earlier this year, the company launched an AI assistant powered by OpenAI’s infrastructure. According to their press release, the assistant:

Produced the work equivalent of 700 full-time agents

Saved ~20% in customer service and operation costs

Achieved ~25% drop in repeat inquiries

Achieved ~80% improvement in resolution time

All while maintaining same customer satisfaction score

In the next sections, we quantify the potential economic impact on GCC public and private companies.

2. There is massive potential for KSA and GCC

There is an immediate opportunity to create AI agent companies worth $18b in aggregate by serving the GCC market only. Such value creation could materialize in 10 companies, each reaching an equity valuation of $1-3 bn by focusing on a specific use case.

An indicative estimate of the potential equity value of AI agents’ companies

In comparison, the technology ventures that have emerged as successful in the GCC so far had a combined value at exit of less than $10bn. Additionally, given the nascency of the AI Agent field, such winners could easily grow beyond our region.

While the calculation methods used here can be challenged and argued, the exercise is meant to develop a sense of the magnitude of the opportunity.

AI agents: $23bn in saving potential for GCC companies

AI agents could generate savings of $4bn for Tadawul (excluding Saudi Aramco), $13bn for Saudi companies, and $27bn for GCC companies.

The above estimates are based on generative AI technology available today and do not factor in potential future innovation.

Methodology to estimate potential savings from agentic solutions

The split of potential savings by sector is a function of the sector's size and the relevance of AI agents within each sector.

For each sector, we identified the relevant use cases for AI agents and the related corporate functions impacted by them (e.g., customer service, marketing, etc.).

We then selected the major industry players listed in Tadawul and applied the cost-saving ratio to the cost base of the impacted function. Finally, we inferred savings to the broader sector through the relative market share of analyzed players.

We estimate that AI agents can enable 10%-30% savings on average of the impacted functions and 4%-8% savings in the overall operating cost for most sectors, with meaningful value creation potential for shareholders. Some industries benefit from them more than others, depending on their relative reliance on impacted functions and profitability level.

AI agent: a booster for tech ventures

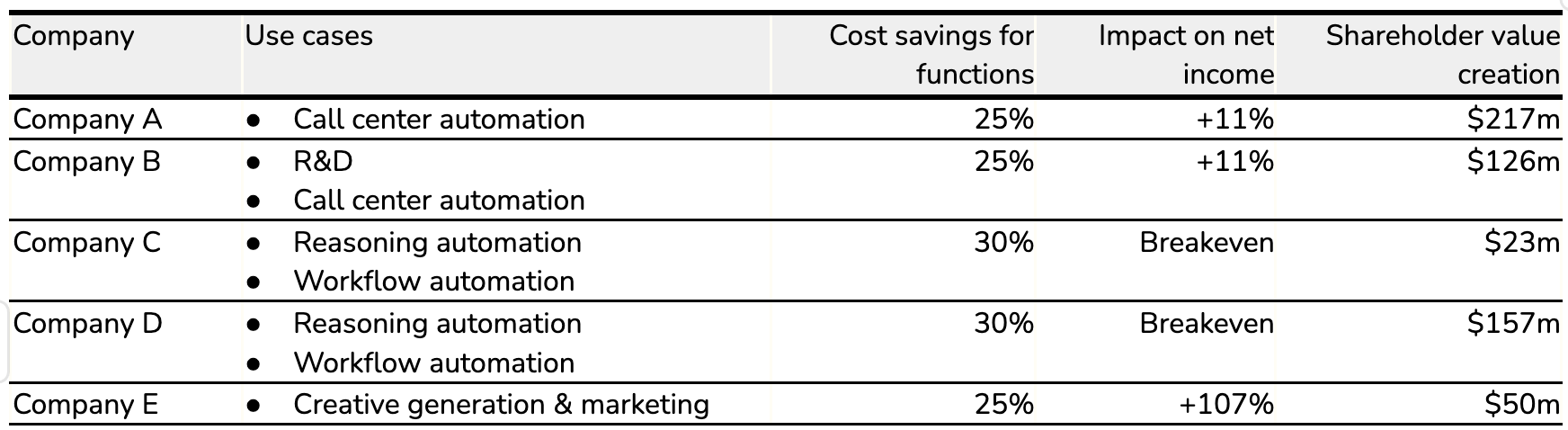

The impact of AI agents adoption on GCC digital ventures is even more significant compared to traditional established businesses in light of the higher weight of their operating costs relative to their revenue. In the exercise below, we selected five STV portfolio companies and analyzed their potential cost savings when using agentic solutions. Given the company valuation and the impact of such a transition on the bottom line, we translated that saving to potential shareholder value.

Cost savings potential for select STV portfolio companies

Looking again at select companies from the STV portfolio, we believe the impact of AI agents on revenue generation outweighs the cost benefits.

Revenue generation potential, examples for select STV portfolio companies

Like many, we believe the near future will bring unicorns with incredibly lean cost structures, some even run by a single person, particularly in specific sectors and business models.

In summary, cost savings and revenue generation are material and are only expected to increase as LLM-based solutions improve. In the coming years, we expect to see more “AI Agents” or “Co-Pilots” augmenting or replacing every function, widening the delta between companies that adopt these technologies and those that do not.

Six enablers need to be in place to achieve the cost savings and value creation mentioned above: three technical (infrastructure) and three soft (business). We discuss these enablers in the following chapters.

3. Infrastructure enablers require further localization

Six main enablers are necessary to unlock the AI Agents opportunity in the GCC: three are technical enablers, and the other three are business enablers. The three technical enablers are models, data centers, and data assets - discussed below.

Models: local dialects, locally hosted and managed

Most AI Agents are built by “gluing” together a set of models to solve a specific business use case. Typically, companies use off-the-shelf components (open source) or third-party AI providers to complete their offering.

For example, an AI Agent company targeting the US market that needs text-to-speech capabilities would likely turn to third-party providers like ElevenLabs (recently raised $80M) or its smaller competitor, PlayHT.

In the GCC region, localized models are limited. For instance, there is no locally-hosted or open-source text-to-speech model with a Saudi accent. As a result, AI Agent companies in Saudi Arabia must build this component from scratch to meet local needs, a challenge that companies in other markets don’t face.

To close the gap in AI models, the GCC should focus on two key actions: (1) developing models tailored to local dialects, particularly speech-to-text and secondary LLMs, and (2) offering these models as locally-hosted managed services for companies to use (inference) or making them available as open-source. This could be achieved through incentive programs that encourage startups to specialize in these models, or through government-affiliated entities leading the development and servicing. Importantly, these models must be easily accessible to users worldwide, with a simple sign-up process and credit card payment, avoiding the need for enterprise-level sales teams.

Data Centers: boost GPU-enabled capacity

Generative AI relies on GPU-enabled data centers for both model training and inference. Large enterprises and regulated entities often require all computation to happen locally, either within their country or on-premise in their own data centers. While training in global data centers is typically acceptable (depending on the dataset), inference will always need to be done locally for regulated entities. In large countries like Saudi Arabia, this becomes a challenge due to the limited number of GPU-equipped data centers. Indeed, Saudi Arabia data center capacity per GDP is at 25% the one of North America.

Data Assets: unlock local, high-quality datasets

To build effective AI models, especially in the context of Generative AI, you need access to large volumes of data that reflect the local language nuances and cultural context. While these can be used in finetuning and regional benchmarks, GCC can also play a role in establishing world-class datasets in specific domains where there is an advantage, such as Energy or Healthcare.

4. Business enablers require funding, corporate engagement

The three main business enablers are capital, talents, and large corporations with the unique ability to enable B2B startups.

Capital: specialized and capable

Due to the early stage of the Generative AI sector and its rapidly changing dynamics, many conventional MENA VC investors hesitate to take on the risks or acquire the know-how necessary for the sector. As mentioned in previous sections, India (comparable GDP to MENA) invested $128m in H1 2024 alone, all focused on application-layer AI companies. Israel, a country with less than half of Saudi Arabia’s GDP, saw $93m invested in application-layer AI startups H1 2024, with the sector overtaking FinTech and Cybersecurity to become the most funded sector by number of deals.

Talents: enough to start, more is needed

Generative AI application-layer products rely more on traditional software engineering than specialized AI expertise. Therefore, the technological barrier to creating AI Agents isn't necessarily higher than in other digital sectors like SaaS. Often, the challenge is using existing components and tools to build platforms tailored to specific use cases. In this regard, the region's technical capabilities are sufficient to capitalize on this opportunity.

Having said that, the region’s strategy should always revolve around attracting and retaining the best global talent, whether AI-specialists or otherwise. While we do not believe that the local talent scene should slow down the GCC from creating value in the application-layer of Gen AI, we are still keen to see this advantage grow and compound to global scales.

Customers: the role of corporates is critical

The GCC needs more mega-corporations to engage with startups. Every B2B company starts with its first customer contract. When a large entity, such as a bank, retail group, or telecom, partners with a seed-stage startup for a proof of concept (PoC), it marks a critical milestone. This success attracts later-stage investors, creating a virtuous cycle of product development and new customer acquisition. This cycle is essential for B2B growth and market expansion. In developed markets like the US, Fortune 500 companies often have dedicated Startup Engagement Teams to foster collaborations and drive mutual value. An incentive program in the GCC (or a simple leaderboard PR) could have an outsized impact on the birth of B2B digital startups, which can later expand beyond their homebase region.

5. Time to action: a window of opportunity is closing

As local investors, we believe we are in a window of opportunity to establish a second homebase for AI giants, and with the right actions, the GCC region is uniquely positioned to seize it.

Consider India. Following the SaaS boom of the 2010s, it emerged as a major player, second only to the United States. Entrepreneurs and investors recognized the opportunity early, developed their product and growth capabilities, and today lead multiple niches with companies like Zoho ($1b+ revenue), Freshworks ($10b IPO), CleverTap, Shipsy, and BrowserStack being a few examples.

We now face a similar dynamic in the AI application layer. With countries worldwide starting from roughly equal footing, it is the perfect time to position our local market as a second homebase. What is needed is (1) capital, (2) talent, and (3) customers.

History shows that successful startups create ecosystems that fuel future ventures - think of the PayPal Mafia or the Careem Mafia. By acting now, we can foster the rise of AI application-layer giants in MENA, creating a lasting impact on the region's tech landscape.